Insurance Carriers Consistently Undervalue Property Damage Repairs; Here’s What You Can Do As a Property Owner to Protect Your Investment

It’s a widely known fact that Insurance carriers will do everything in their power to undervalue and/or deny property damage claims. From hiring third party adjusters, to coverage denials based solely on terminology used while filing a claim, insurance companies are leaving property owners who are already facing a crisis left with mountains of debt or unsafe living conditions.

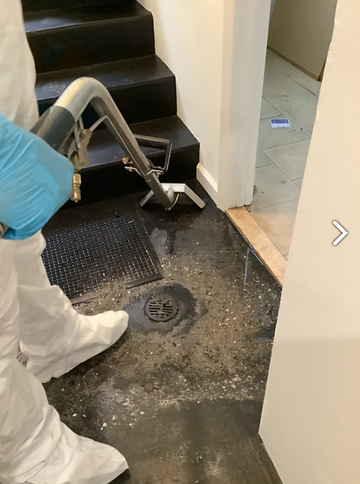

Imagine waking up to over a foot of water in your basement. You have extensive property damage due to a failed sump pump and all of your belongings are saturated with water that has backed up from a sewage drain line. Your walls are wet, floors are buckling, belongings are ruined and out of caution, you immediately contact a plumber and mitigation specialist to come and fix the faulty appliance, extract the standing water, remove affected and unsalvageable materials and perform necessary services that help prevent costly secondary damages like microbial growth and structural issues. Your next call is to your insurance agent to file a claim and let them know you have done your due diligence and initiated these services. Then, a few days later, after everything is properly repaired, mitigated and restored, the professionals you hired to help turn your disaster into peace of mind provide you and your insurance adjuster with an invoice for their services and request payment.

Remember above, when we said that Insurance carriers will do everything in their power to undervalue or deny property damage claims? Just because you bought a policy, does not mean it will cover all of your costs.

It’s at this point in the process that we’re seeing the unjust enrichment of our valued clients.

In recent experiences with certain national insurance companies, the claims adjuster no longer cares about bedside manner towards their customer, or – about providing fair compensation to them for services they were required to enlist. And, because property damage claims are being so heavily scrutinized, policyholders (our clients) are now only being offered penny’s on the dollar for the emergency services they’re required to commission.

Insurance Carriers Transition From Claims Adjusters to Third Party Administrators

The main goal of a claims adjuster is to reduce the liability of the insurance carrier that they work for. In fact, adjusters now rarely even visit or inspect your property after a loss. Whether this is due to Covid-19 or otherwise, we’re seeing a trend where carriers are relying more heavily on businesses like Tri State Restorations to provide them with extensive jobsite records, including: hundreds of pre-and post-loss photos, logs that demonstrate successful mitigation and drying processes and reports that prove everything that was done, was done according to the Institute of Inspection Cleaning and Restoration Certification (IICRC)’s standards.

May 12th is fast approaching and moms throughout Maryland, Virginia and Washington, DC are wondering… will it be an awesome day of surprises from their loving family, or just another day of “being mommy.” With a bit of help from us and a little time, effort and/or money we guarantee you can make Mother’s Day 2019 the absolute best she’s ever had since… well… Mother’s Day 2018!

Let’s start with a few out-of-the-box gifts and products you can buy right now and move into a few ideas suited to our “craftier” readers.

We’ve also seen an influx of claims that aren’t even being processed by the insurance carrier. Instead, they’re being sent to hard-to-reach 3rd party administrators, with little industry knowledge or experience, to do two things:

- Lower the value of work that was “performed.” This is not necessarily based on the submitted invoices, services or extensive reporting provided by companies like Tri State but, instead are based solely on what they believe should have been done and often, that only includes the bare minimum requirements of IICRC industry standards for property damage and mitigation.

- Look for loopholes in your claim and/or policy that will allow them to deny all or part of the coverages associated with your property damage.

Now imagine another scenario, where instead of immediately seeking help from a licensed contractor you decide to avoid paying out of pocket up front and request an estimate because you’re concerned about costs and liability. Now you have a scope of work detailing what it would take to properly mitigate your property damages, but there’s no guarantee all, if any of it will be covered. So, what happens when your insurance carrier denies coverage due to negligence because you didn’t immediately act to prevent secondary damages? Or, perhaps they deny you coverage because while filing your claim, you said that damage was caused by a “slow leak” in a pipe and your policy only covers damage from “sudden bursts”.

Either you, as the homeowner, will then need to find a way to pay for expensive emergency services out of pocket or decide to improperly take care of the damages on your own to save money (i.e. use a shop vac). The worst decision we hear homeowners make is that they’ve decided to just “let it air dry.” This ultimately flags you to your insurance carrier as negligent and worse, exposes your property’s occupants aka your loved ones, to serious health hazards including but not limited to: allergic reactions from microbial & mold growth, illness from chemical exposure like volatile organic compounds, illness from damaged building materials containing lead and asbestos, and viral or bacterial infection and illness.

How do you advocate for yourself as a property owner to ensure your loss is covered?

Read and understand your property insurance policy. That answer may sound simple, but it’s much more complicated than that.

After polling over 300 Washington D.C. metro area insurance agents and adjusters on how to best serve their clients, Tri State Restorations received one consistent piece of advice: make sure homeowners are reading and comprehending their policy (annually!) AND know their coverage limits. Scheduling an annual appointment with your insurance agent to review your policy at the time of renewal not only helps you to understand what’s covered and what isn’t, it allows you to see what’s changed and ask questions about what to look out for when disaster strikes.

The bottom line: Homeowners that are already dealing with the stress and hardship of a property disaster are being unfairly compensated by their insurance carrier for the costs associated with repairing and mitigating their property’s damages at sometimes pennies on the dollar.

Help us stop these insurance carriers from bullying responsible homeowners out of the services they need and deserve. Our clients did what they were supposed to do during an emergency – they took immediate action, hired a local, certified and reputable emergency disaster firm to properly mitigate their loss and restore their property to its former pre-loss conditions. They deserve to be fairly compensated.

You are allowed to choose who you want to hire and have in your home. It is your insurance company’s responsibility to pay a reasonable and fair claim settlement to you for these services. Don’t get left footing the bill due to their negligence!

If you are experiencing difficulties with your claim and feel this article has brought to light serious concerns in your own claim here are a couple of resources for you:

- https://insurance.maryland.gov/consumer/pages/fileacomplaint.aspx

- https://scc.virginia.gov/pages/File-an-Insurance-Complaint-(1)

- https://disb.dc.gov/service/file-complaint-or-report-fraud

- https://www.ftc.gov/about-ftc/bureaus-offices/bureau-consumer-protection

- https://www.amazon.com/Delay-Deny-Defend-paperback-JayM-Feinman/dp/0989501701/ref=sr_1_2?keywords=delay+deny+defend&qid=1638212617&s=books&sr=1-2

- https://www.amazon.com/Claims-Game-Deceptive-Insurance-Companies/dp/1483437019/ref=sr_1_1?keywords=The+Claims+Game&qid=1638212646&s=books&sr=1-1

- https://insurance.maryland.gov/consu

mer/pages/fileacomplaint.aspx - https://scc.virginia.gov/pages/File-an-Insurance-Complaint-(1)

- https://disb.dc.gov/service/file-complaint-or-report-fraud

- https://www.ftc.gov/about-ftc/bureaus-offices/bureau-consumer-protection

- https://www.amazon.com/Delay-Deny-Defend-paperback-JayM-Feinman/dp/0989501701/ref=sr_1_2?keywords=delay+deny+defend&qid=1

638212617&s=books&sr=1-2 - https://www.amazon.com/Claims-Game-Deceptive-Insurance-Companies/dp/1483437019/ref=sr_1_

1?keywords=The+Claims+Game&qid=16

38212646&s=books&sr=1-1

In recent experiences with certain national insurance companies, the claims adjuster no longer cares about bedside manner towards their customer, or – about providing fair compensation to them for services they were required to enlist.

Sharing is caring!